An FHA multifamily financing are a mortgage, covered by Government Property Government (FHA), that is always purchase property containing five or higher equipment. FHA multifamily funds vary off simple FHA mortgage loans, which have varying official certification and loan restrictions.

What’s a keen FHA multifamily loan?

New U.S. Department out-of Houses and you may Metropolitan Invention (HUD) defines a beneficial solitary friends dwelling overall having between you to five tools. This is important to note just like the, it is able to use old-fashioned FHA money, homeowners can also enjoy a similar professionals that include financial support an individual device. This type of professionals tend to be:

- Lowest advance payment

- Possibly straight down interest levels

- Higher financial obligation proportion allowances

- Smaller strict credit standards

An enthusiastic FHA multifamily loan allows homebuyers and you can a home dealers so you’re able to get an effective multifamily house, categorized from the FHA while the a home with four units otherwise way more. Attributes spanning multiple product, but less than four, particularly a duplex, is actually considered solitary-family members construction which means, ineligible for an FHA multifamily mortgage. To help you be eligible for a good multifamily proprietor-filled mortgage, the home need to have five or even more products.

Multifamily finance can be then split depending on if or not your prefer to go on the house or property (owner-occupied) or otherwise not. Characteristics which have five or even more devices will get be eligible for industrial funds designed for holder-occupied aim.

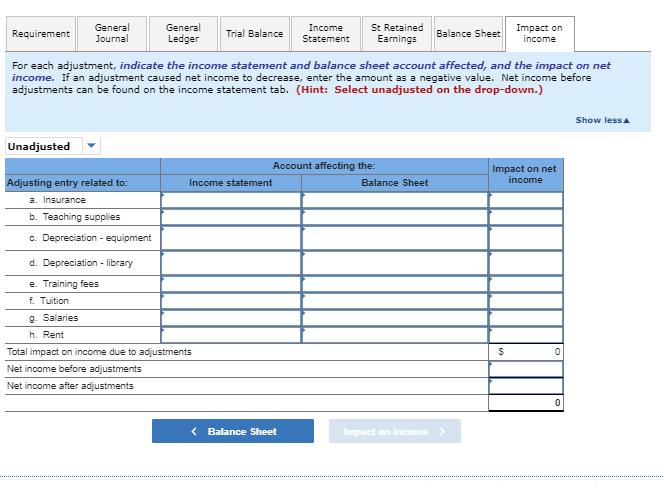

FHA multifamily Alabama payday loans website financing official certification

Like other kinds of mortgages, your own eligibility to possess a keen FHA multifamily loan depends on affairs including since your credit history, money, and loans-to-income proportion (DTI). Discover added situations, not, when obtaining assets designs with several equipment.

Very first, be prepared to give information regarding the possibility leasing income of the home. Others attribute when purchasing more devices try large financing limits. These types of limits boost according to the number of products put in the house or property.

In contrast to unmarried-home financing, which have borrowing from the bank limits influenced by how many equipment and you can occupancy agreements, FHA multifamily money do not have a higher credit limit.

In order to be eligible for FHA multifamily funds, you must have financing-to-worthy of (LTV) proportion with a minimum of 87% so you can ninety%. It indicates you will have to make an advance payment off ranging from 10% and you can thirteen%, equating so you can $10,000 so you can $thirteen,000 for each and every $100,000 borrowed.

For each and every tool from inside the assets must include an entire kitchen and you can restroom, and the entire property need already been both finished or experienced a major renovate in this 3 years just before distribution the application.

FHA multifamily financing limits 2024

Ascending home prices provides contributed to increased FHA mortgage constraints to have 2024. The maximum mortgage limitations to have FHA submit mortgage loans commonly boost in step three,138 counties. Within the 96 areas, FHA’s mortgage constraints will continue to be undamaged.

- One-unit: $498,257 for the reduced-costs section and you can $step one,149,825 inside the high-prices components

- Two-unit: $637,950 into the reasonable-cost portion and you can $step 1,472,250 into the high-cost portion

- Three-unit: $771,125 within the low-costs portion and you will $1,779,525 when you look at the highest-costs parts

- Four-unit: $958,350 inside reasonable-costs elements and you can $2,211,600 to have high-pricing components.

Positives and negatives

FHA fund should be an excellent option for buying an effective multifamily house or apartment with as much as 4 tools. Of course, mortgage borrowers should think about both advantages and cons.

Reduce fee demands. FHA financing wanted a down payment from only step three.5%. You may be capable blend a keen FHA mortgage that have down commission guidelines, leading to no down payment.

Straight down rates. Typically, specially when you are looking at mortgage borrowers having straight down credit scores, FHA funds convey more aggressive mortgage cost.

Combine with an effective 203K loan. Having an enthusiastic FHA multifamily loan, you can purchase a good 203k repair financing and link it for the the mortgage, allowing you to create just one fee.